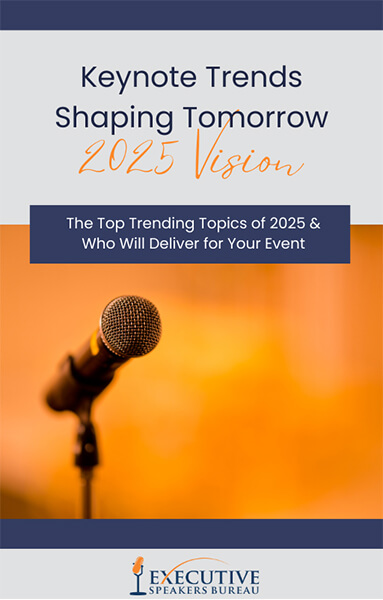

Executive Speakers Bureau is a global speaker’s bureau representing the most innovative keynote speakers who want to share their passion and creativity to make a difference in the world. We take pride in our ability to provide world class service as well as our ability to deliver today's foremost professional business speakers and expert trainers to clients around the world. It is our commitment to provide our clients with unparalleled service, access to thousands of motivational speakers worldwide and individualized personal attention.

Your event provides a chance to educate, encourage, connect and motivate a room full of people. Having the right keynote speaker at your event matters and that’s why we’re here to help. At Executive Speakers Bureau we manage and match premiere keynote speakers from around the world to make your event a memorable one.

So, You Want a Keynote Speaker For Your Next Event...

Now What?

Enter your work email below to claim your complimentary ebook.

© 2024 Executive Speakers Bureau. All Rights Reserved.

Design and Developed by eBiz Solutions

Get Ideas in 1 hour or less

Executive Speakers Bureau consistently receives praises about our speed and efficiency. From the beginning of your event planning, our extensive online speaker database and resourceful staff allow us to quickly equip you with the best speaker for your event.

Need a last minute speaker? No worries. Our speed and efficiency help us give you ideas for speakers in one hour or less.